Varylora Cross-Border VAT Support

Providing assistance with cross-border tax recovery and VAT refund processes for Canadian travelers and businesses.

- Simplify VAT refund procedures

- Support for international transactions

- Centralized management platform

+1,200

Clients served

+2,500

Claims processed

98%

Customer satisfaction

Our services are intended to support international VAT refund and cross-border tax recovery processes for clients in Canada.

Varylora | Canada | en

Our promotions highlight a dedicated approach to assisting with international VAT refunds and cross-border tax recovery. The process is designed to simplify the often complex procedures involved in reclaiming taxes from different jurisdictions. By focusing on efficient documentation and compliance, the service aims to support businesses and individuals in navigating the intricacies of cross-border transactions. This approach is intended to help streamline the refund process, potentially reducing administrative burdens and fostering smoother international trade operations.

International VAT Refund and Cross-Border Tax Recovery Promotions

Get Help Now

About Varylora Our Commitment to Cross-Border VAT Refund and Tax Recovery Assistance

Our approach to international VAT refund assistance and cross-border tax recovery is designed to support businesses and travelers navigating complex tax procedures. We focus on simplifying the process by providing clear guidance and efficient handling of refund claims across various jurisdictions. Our goal is to help streamline compliance and potentially recover eligible taxes, making international transactions more manageable. With a client-centric mindset, we aim to assist clients in addressing their VAT and tax recovery needs, fostering smoother cross-border experiences.

Contact us to learn how our approach may support international VAT refund processes and cross-border tax recovery efforts. We focus on understanding your needs and providing tailored assistance to navigate complex regulations. Our team is available to answer questions and discuss how our services can fit your specific requirements. Reach out to start a conversation about simplifying your VAT claims and optimizing your cross-border transactions. We look forward to hearing from you and exploring potential solutions together.

Connect with Varylora for International VAT Refund and Cross-Border Tax Recovery Assistance

International VAT Refund Support and Cross-Border Tax Recovery Solutions

Our approach supports international VAT refund assistance and cross-border tax recovery, helping streamline compliance across borders.

Our approach supports international VAT refund processes and cross-border tax recovery, helping streamline your global transaction management.

Varylora International VAT Refund Support and Cross-Border Tax Recovery Services

International VAT Refund Procedures

International VAT refund procedures outline the steps for reclaiming VAT on eligible purchases made in foreign countries, facilitating compliance and smooth processing for travelers and businesses.

Cross-Border Tax Recovery Processes

Cross-Border Tax Recovery Processes may support organizations in navigating international tax procedures and identifying potential recovery opportunities across different jurisdictions.

VAT Refund Eligibility Criteria

This section outlines the criteria that determine eligibility for VAT refunds, helping you understand the necessary requirements and conditions.

Claim Submission Guidelines

This section provides guidelines to assist with the claim submission process, outlining necessary steps and required documentation for a smooth and efficient experience.

Refund Processing Timelines

Refund processing timelines indicate the typical duration for refunds to be completed after a return is initiated. This information can help with planning and understanding the expected timeframe for refunds.

Common VAT Refund Challenges

Common VAT refund challenges may include documentation issues, complex procedures, and varying regulations that can impact the refund process. Understanding these obstacles can help with smoother VAT recovery experiences.

Our Products

Varylora Cross-Border VAT Navigator

Streamline your international shopping with Varylora's Cross-Border VAT Navigator. This service simplifies the process of reclaiming VAT from multiple countries, helping travelers and businesses optimize their tax recovery efforts. With a user-friendly interface and comprehensive support, it may support more efficient cross-border transactions, saving time and reducing hassle for Canadian consumers exploring global markets.

Learn MoreVarylora Global Tax Recovery Suite

Discover a modern approach to cross-border tax recovery with Varylora's Global Tax Recovery Suite. Designed for frequent travelers and international shoppers, this solution offers tailored assistance in navigating complex VAT refund procedures across various jurisdictions. Its flexible features aim to support seamless claims, making international spending more rewarding for Canadian users.

Learn MoreVarylora International VAT Support Portal

The Varylora International VAT Support Portal provides a centralized platform for managing VAT refund requests from abroad. It features real-time tracking, document management, and personalized guidance to help navigate the intricacies of cross-border tax recovery. Crafted for the modern Canadian traveler and business, it may support a smoother, more transparent refund experience.

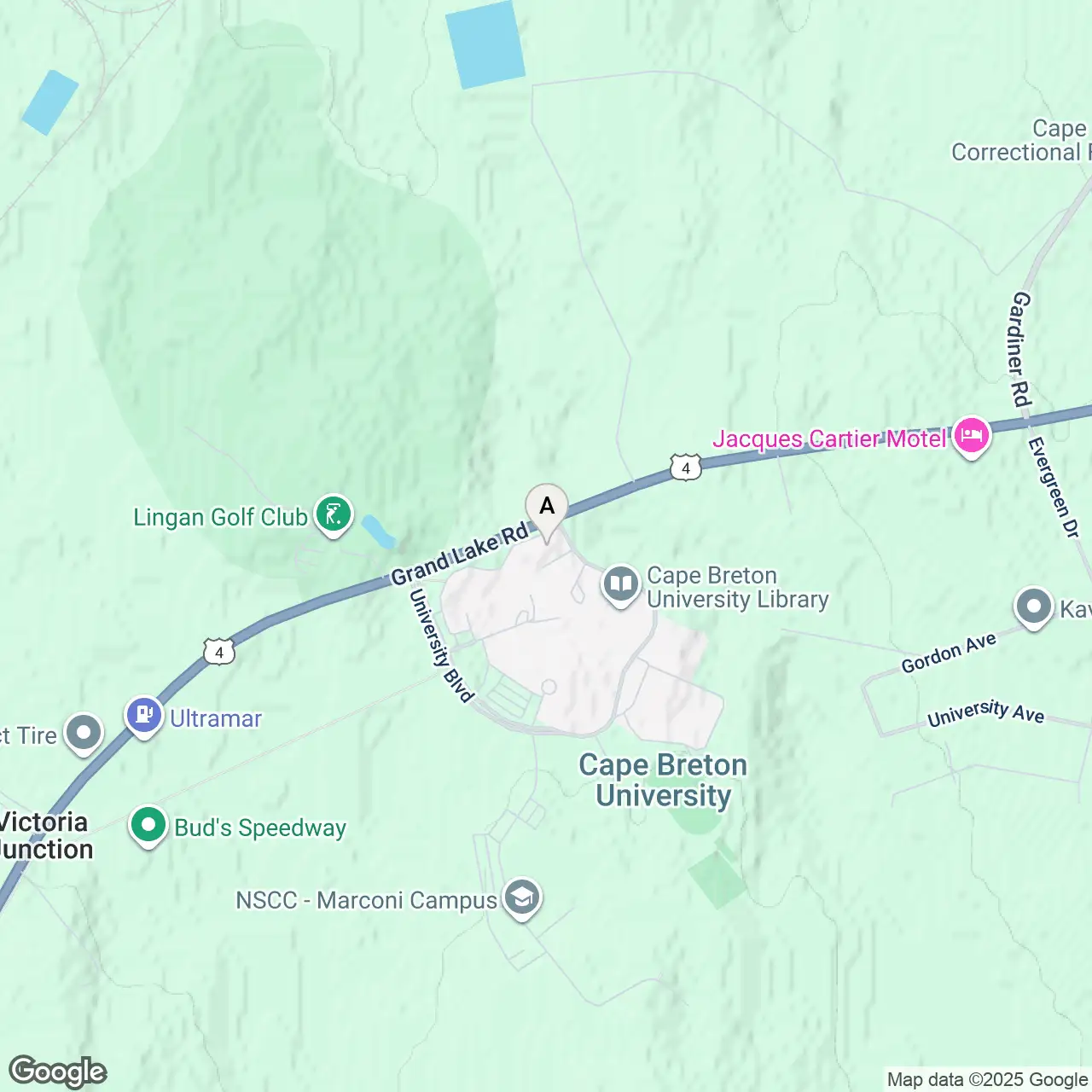

Learn More1250 Grand Lake Rd, Sydney, NS B1M 1A2, Canada

Business Number:

869210334

Contact Varylora for International VAT Refund and Cross-Border Tax Recovery Assistance

Our contacts section provides a way to reach out for assistance with international VAT refund processes and cross-border tax recovery. The approach focuses on understanding client needs and navigating complex procedures to support efficient claim management. Whether you require guidance on documentation or assistance with compliance, our team is here to help with your specific requirements. We aim to facilitate communication and provide the information needed to simplify your international tax recovery efforts. Please contact us to learn more about how we can support your objectives.